What Happens in Vegas Doesn’t Stay in Vegas

We are back from Vegas and excited to talk about our experience at the National Credit Union Call Center Conference (NCUCCC). Held at the MGM Grand in Las Vegas, NCUCCC 2022 provided the CallFinder team with an amazing opportunity to connect with credit unions from across the country and learn more about what’s happening in the industry. Laura Noonan, CallFinder’s Chief Revenue Officer, and Business Development Executives, Chip Hoffman and Allen Bergseth (pictured left with Juan Fernandez Ceballos, President & CEO of the Credit Union Association of NM) all attended the event, and unlike most things that happen in Vegas, this experience will not stay in Vegas.

Here are some of the highlights and takeaways from the 2022 conference. But first, let’s learn more about NCUCCC.

About the Event

The National Credit Union Call Center Conference (NCUCCC) has been running for over 20 years. During that time, the organization has helped call centers solve everyday issues and plan for their future. Every year, credit unions of all sizes send call center directors, managers, and members of their executive teams to the event. NCUCCC 2022 focused on creating processes to improve the member experience while helping to improve employee workloads and morale.

NCUCCC 2022 Takeaways

During the interactive workshops with subject-matter experts, daily breakout sessions, and casual lunches, our team learned a lot about what’s happening in the credit union space. From “fraudsters” to difficult members, Member Services agents have their work cut out for them. Here’s what the CallFinder team learned about these challenges, and how our speech analytics solution can help.

Kindness: The New Call Center Trend?

In the interactive keynote titled, “Economy of Kindness: How Kindness Transforms Your Bottom Line,” Linda Cohen explained why kindness is so crucial in the workplace because, according to Cohen, it “enhances employee morale, increases retention, and creates loyalty from customers and clients.”

Laura Noonan’s impression of the keynote echoed this sentiment: “Linda Cohen was tremendous, focusing on conducting life, personal and business, with kindness.” Noonan remarked after the event.

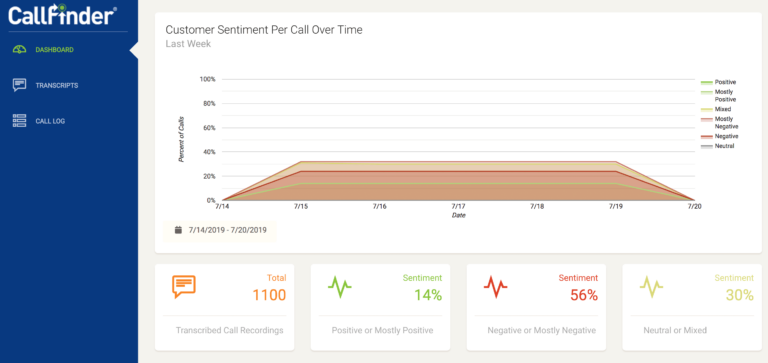

While this concept may seem revolutionary to some, expressing kindness is nothing new to CallFinder. Our unique sentiment analysis and emotion detection helps call center managers understand what’s happening emotionally – both for the agent and the caller – on every call. These insights help managers create nuanced training programs on soft skills.

Fraudulent Callers

“We heard a lot of talk during our lunches about ‘fraudsters’ who pose as members on live phone conversations,” said Laura Noonan. According to Noonan, these fraudulent callers are getting better at learning how to get verified as members. Luckily, credit unions that use an automated QA solution, such as CallFinder, can quickly locate these calls using searchable transcriptions. They can use those conversations to train new agents on how to spot a fraudster before it’s too late.

Difficult Conversations with Members

Another common thread during these conversations was the increasing number of conversations with difficult members. Noonan says, “We also heard about how a lot of time is spent helping agents cope with tough members and verbal attacks.” That’s never something you want to hear from your agents, especially when you’re so focused on improving the member experience. Your agents’ experiences definitely matter too, especially with the high turnover rate in call centers.

Dealing with aggressive callers is something that we have helped countless clients overcome. And it all starts with training agents on how to handle these callers in a constructive way. The best way to do that is by using the actual calls. With CallFinder, you can define your own insights (aka, what you want to focus on) using our intuitive interface. Plus, with help from one of our dedicated analysts, you can learn how to best use our solution to meet your needs and overcome your specific challenges. In fact, CallFinder’s Managed Client Services is what sets us apart from our competitors.

Manual Call Reviews Are Not the Way

During the event, we promoted a common theme in our materials: “Manual Call Reviews? There’s a Better Way,” and this really resonated with attendees. Everyone our team had a chance to speak with finds manual QA tiring, taxing, and insufficient. In fact, many told CallFinder that they are hard-pressed to monitor even 1.5% of their calls.

One of the best benefits of CallFinder is that you get 100% visibility into your calls. Our automated call quality monitoring solutions provide features that give you access to every aspect of your customer conversations, scoring 100% of your calls. Plus, CallFinder gives QA managers a more accurate view into agent performance, and it saves time that managers can spend on coaching agents.

More On How CallFinder Helps Credit Unions

At CallFinder, we know that credit unions are faced with many challenges. Ensuring a positive member experience, maintaining Net Promoter Scores, and compliance risk make life difficult for credit unions and their call centers. CallFinder makes it easy to offer the best experience for your members, while increasing payment rates and maintaining financial service compliance.

Learn how to overcome challenges and drive success with interaction insights from CallFinder’s user-friendly, automated quality monitoring solution. Schedule your demo today!