If there is one thing credit unions want people to know, it’s that they are NOT banks. Credit unions are member-owned and offer unique services and benefits. This means credit unions have distinct language and terms they use in their industry. So naturally, they would want an automated quality monitoring solution that understands – and speaks – their language. And CallFinder’s solution does just that.

CallFinder works with credit unions from all over the country to help them enhance the member experience and grow revenue. We understand each credit union’s needs on both an industry and an individual level. Here are just a few of the ways the CallFinder solution has proved itself to credit unions.

Automated Transcriptions to Better Understand Members’ Wants and Needs

CallFinder’s automated call transcriptions convert all inbound calls from speech to text, for a quick and easy analysis of your agent-member interactions. These transcriptions are quickly scanned for specific keywords and phrases that you set. This information identifies trends and patterns that reveal member insights within the calls. Credit unions can then make more informed decisions and train agents on how to better serve their members.

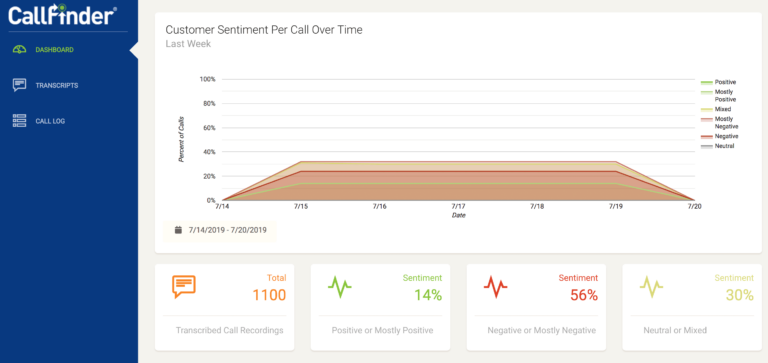

Sentiment and Emotion Analysis to Identify Member Pain Points

Credit unions take pride in the personalized member services that they offer. This level of service means credit unions must go beyond surface interactions. They need an in-depth comprehension of how members truly feel about those interactions. CallFinder’s sentiment and emotion analysis provides just that.

This feature identifies words and phrases that evoke a response (aka sentiment), as well as acoustic modulations (aka emotion) to quantify the overall mood of a conversation. Knowing how many positive or negative experiences your members have, and how often, can help with agent training and, therefore, positively influence future interactions.

Managed Client Services Means Built-In Support for Life

Each CallFinder client is assigned to an expert Analyst who works closely with the client’s QA team. This Analyst assists in defining business goals and solution implementation, and continues providing support whenever the client needs it. And since CallFinder is well-versed in credit union terms, our Analysts already have a deep understanding of what makes a credit union successful. Our Analysts help impact the member experience in ways a manual QA process simply cannot match.

Join the CallFinder Family!

CallFinder continues to add new credit unions to its list of clients. And we’d love to add you to that list and help your credit union succeed! Discover how we can help your credit union gain 100% visibility into the member experience. Book your no-obligation demo today!